- Apple pledged an additional $100 billion to U.S. manufacturing, raising its total stateside investment commitment to $600 billion over four years.

- A new partnership with Samsung will bring iPhone image sensor production to Austin, Texas—a first for Apple’s domestic supply chain.

- Apple secured an exemption from the new 100% semiconductor import tariff, thanks to its U.S. manufacturing commitments, under a policy introduced by President Trump.

It was a strange sort of ceremony—part product launch, part political rally, part corporate handshake.

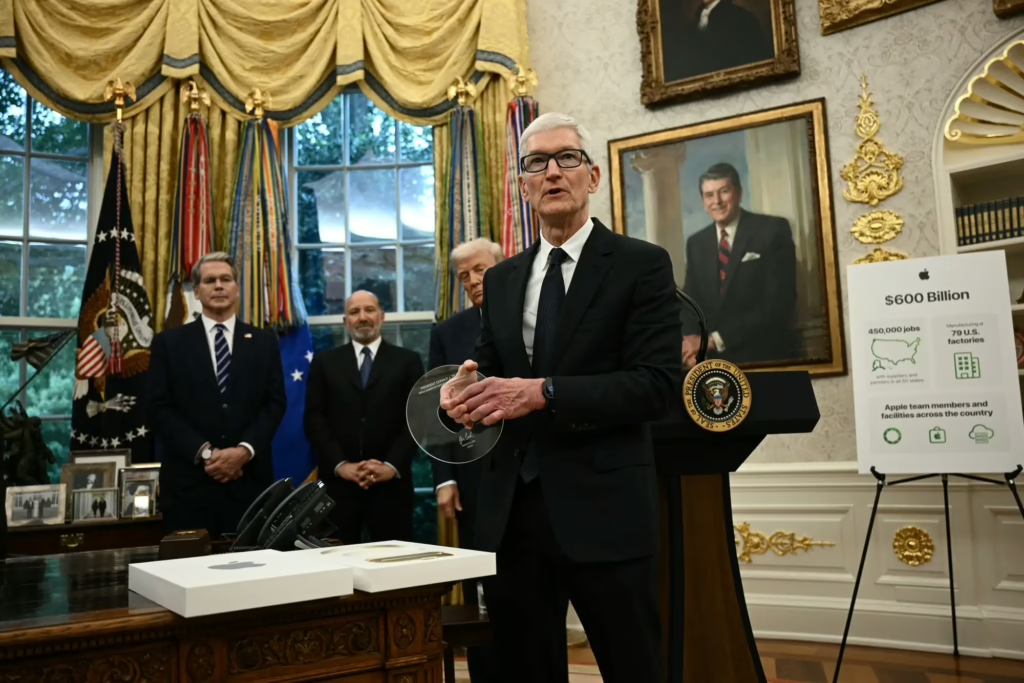

Tim Cook stood at the White House today, not in front of a curtain unveiling the next iPhone, but beside a former president, holding up a gleaming, 24-karat gold plaque embedded in Apple glass. The inscription was custom-etched, made at the company’s facility in Kentucky, and the message was clear: Apple is staying in America.

The occasion? Apple’s CEO had come to announce one of the largest industrial investments in U.S. corporate history: $100 billion in additional domestic manufacturing, pushing the company’s total American commitment to $600 billion over four years.

But behind the pomp—gold, and glass—was a complex maneuver of global supply chains, economic policy, and geopolitical chess. Apple’s new investment wasn’t just patriotic. It was strategic.

Tariffs, Timing, and Texas

President Trump recently announced a 100% tariff on all imported semiconductors—a seismic shift that threatened to disrupt the electronics industry worldwide. But alongside the penalty came a carrot: companies investing significantly in U.S. manufacturing could earn exemptions.

Apple moved fast.

Today’s event revealed the deeper reason for Cook’s visit. In addition to its growing investment in glass, chips, and research facilities across America, Apple is now partnering with Samsung to manufacture advanced digital image sensors for iPhones in Austin, Texas. That’s a first. Samsung had previously produced these sensors exclusively in Korea and Japan.

This new stateside facility gives Apple not only tariff immunity but also one more piece of a domestically controlled supply chain—a crucial advantage in a world where microchips are as strategically sensitive as oil once was.

“This is not just about economics,” said an industry executive familiar with the deal who asked to remain anonymous. “It’s about leverage. Apple wants to be immune to geopolitical shocks.”

And, apparently, to tariffs too.

The $600 Billion Strategy

Apple’s American Manufacturing Program, or AMP, now stands at $600 billion—a colossal investment spanning R&D hubs, data centers, semiconductor fabs, and now, image sensor manufacturing.

In the last decade, Apple has relied heavily on East Asian partners—TSMC in Taiwan for chips, Foxconn in China for assembly, Sony in Japan for image sensors. But that model is showing cracks. COVID-era delays, growing tensions over Taiwan, and now the tariff war have all pushed Apple to rethink where its most vital components are made.

This latest expansion—particularly the Samsung partnership—signals a new model: U.S.-based component manufacturing tied to tariff policy, with final assembly still largely offshore.

For now.

Wall Street responded swiftly. Apple’s stock jumped 3.4% in early trading, with analysts praising the company’s foresight. “Investors were worried about the cost impact of the tariffs,” said Citi’s senior tech strategist Lisa Thornton. “This move neutralizes that threat.”

But not everyone is cheering.

A Complex Dance with Washington

Critics note that Apple’s partnership with Samsung—a Korean firm—complicates the narrative. Yes, the components will be made in Texas, but the profits and intellectual property aren’t purely American. Nor is the final assembly of iPhones, which will still take place overseas.

“It’s a half-measure,” said Jake Warner, a senior fellow at the American Manufacturing Institute. “We’re not getting a U.S.-made iPhone. We’re getting a U.S.-assembled sensor. That’s progress, but let’s not pretend it’s the endgame.”

Still, Apple’s calculus seems clear: make enough in the U.S. to earn goodwill, evade tariffs, and shore up supply resilience—without unraveling its globally optimized cost structure.

President Trump, for his part, took the moment to position Apple’s move as a victory for his economic vision. “This is what American greatness looks like,” he said, holding up the Apple‑made gold plaque with a broad smile.

No word yet on whether that plaque qualifies for a tariff exemption too.

What Comes Next?

As the dust settles from today’s announcement, the tech world is left with a few key questions:

- Will Apple eventually bring final iPhone assembly to the U.S., or is this the outer limit of domestic expansion?

- Could Samsung’s U.S. sensor facility undercut Japanese rivals like Sony, reshaping global competition in camera tech?

- Will other tech giants follow suit—or resist the pressure to localize manufacturing?

Apple hasn’t answered all of these yet. But with $600 billion on the table, it’s clear the company isn’t just reacting to tariffs. It’s laying the groundwork for a post-globalized supply chain—one that can flex across political lines, tariff regimes, and manufacturing borders.

As Tim Cook left the stage this afternoon, he didn’t take questions. But he did offer a hint in his parting words: “When we say ‘Designed by Apple in California,’ we want that to mean something more.”

Today, it does.